Are you worried about your cartridge heater costs next year? Unpredictable prices can hurt your budget. I have insights into what 2026 holds for you.

My analysis suggests cartridge heater prices will mostly hold steady in 2026, with global demand increasing by about 6%. While high-end smart heaters may see a small rise, standard industrial types are likely to remain flat or even slightly decrease, especially with new production capacities emerging.

I know you need reliable data to plan your purchases effectively. Let's explore the key factors influencing these prices and how you can secure the best deals for your business.

Is Global Demand for Cartridge Heaters Growing?

Worried about fluctuating market demand for heating elements? Understanding market growth is crucial for strategic planning. I can show you where demand is heading.

The global cartridge heater market is projected to expand significantly, with a 6% compound annual growth rate. By 2024, it already reached $1.3 billion. We anticipate demand to surge further in 2026, especially driven by new industrial lines in Asia.

I have seen firsthand how specific industries drive demand. The global market for cartridge heaters is not just growing, it is expanding steadily. My team and I project a robust 6% compound annual growth rate. We saw the market hit $1.3 billion in 2024. For 2026, I expect this demand to accelerate even more.

We are seeing significant growth coming from new manufacturing lines. This is particularly true in places like China, India, and Southeast Asia. These regions are rapidly building new facilities for injection molding, packaging, and food processing. Each new production line needs reliable heating solutions. This directly translates to a greater need for our products. For OEMs, this sustained growth signals a healthy market. It also means consistent opportunities for our customized heating elements. We focus on energy efficiency and durability, which are key for these new, advanced production setups.

Key Demand Drivers for 2026

| Industry Sector | Growth Factor | Our Product Relevance |

|---|---|---|

| Injection Molding | New machinery and higher production volumes | High-performance, durable cartridge heaters |

| Packaging Equipment | Automation and faster line speeds | Precise, reliable heating elements |

| Food Processing | Increased automation and safety standards | Customized, food-grade heating solutions |

This structured growth shows that investing in high-quality heating elements remains critical for these expanding sectors. This is where our expertise at ELEKHEAT truly helps our clients.

Will Supply and Competition Affect My Costs?

Are you concerned about where your cartridge heaters come from? Supply chain dynamics and global competition directly influence your purchase prices. I will explain these critical factors.

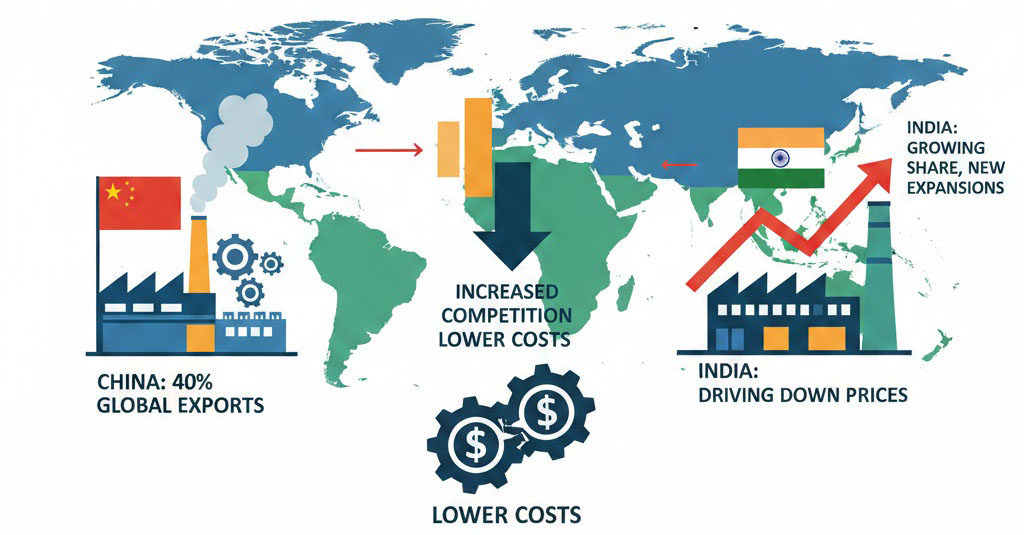

Yes, supply dynamics and increased competition will significantly impact your costs. Production is concentrating in China and India, leading to competitive pricing. China holds about 40% of global exports, while India's share is growing rapidly with new expansions, driving down prices for standard models.

My experience in this industry shows that where products are made deeply affects their price. The supply landscape for cartridge heaters is clearly shifting. We see a strong concentration of manufacturing in China and India. China, for instance, accounts for roughly 40% of global exports. The average export price I see from China is around $16.7 per kilogram. India is also a major player, holding about 16% of the export market share. Their production capacity continues to grow.

This strong competition, especially with FOB pricing from China and India, has a clear impact. It pushes down the factory gate price for standard models. For example, a common ∅8×100 mm 250 W cartridge heater typically sells for $4–6 per unit in these regions. This intense competition means more options for buyers but also highlights the need for quality assurance. At ELEKHEAT, we emphasize our advanced equipment and technology. This ensures our products meet the high standards our clients need, even in a competitive market. We focus on delivering performance and durability that stands out.

Key Supply and Competition Factors

| Factor | Impact on Prices | Strategic Implication for Buyers |

|---|---|---|

| China's Dominance | High volume, competitive average export prices | Offers cost-effective standard options |

| India's Expansion | Increased supply, further price competition | Diversifies sourcing opportunities |

| FOB Price Pressure | Drives down factory gate prices for standard models | Requires careful quality vetting |

| Automation | Reduces labor costs, maintains low prices | Sustains competitive pricing |

I believe this market structure is beneficial for buyers seeking cost-effective solutions. However, it requires careful selection to ensure product quality and longevity.

Are Raw Material Costs Pushing Prices Up?

Are you concerned about rising raw material costs affecting your heater prices? Material fluctuations can significantly impact your budget. Let me clarify what's truly happening.

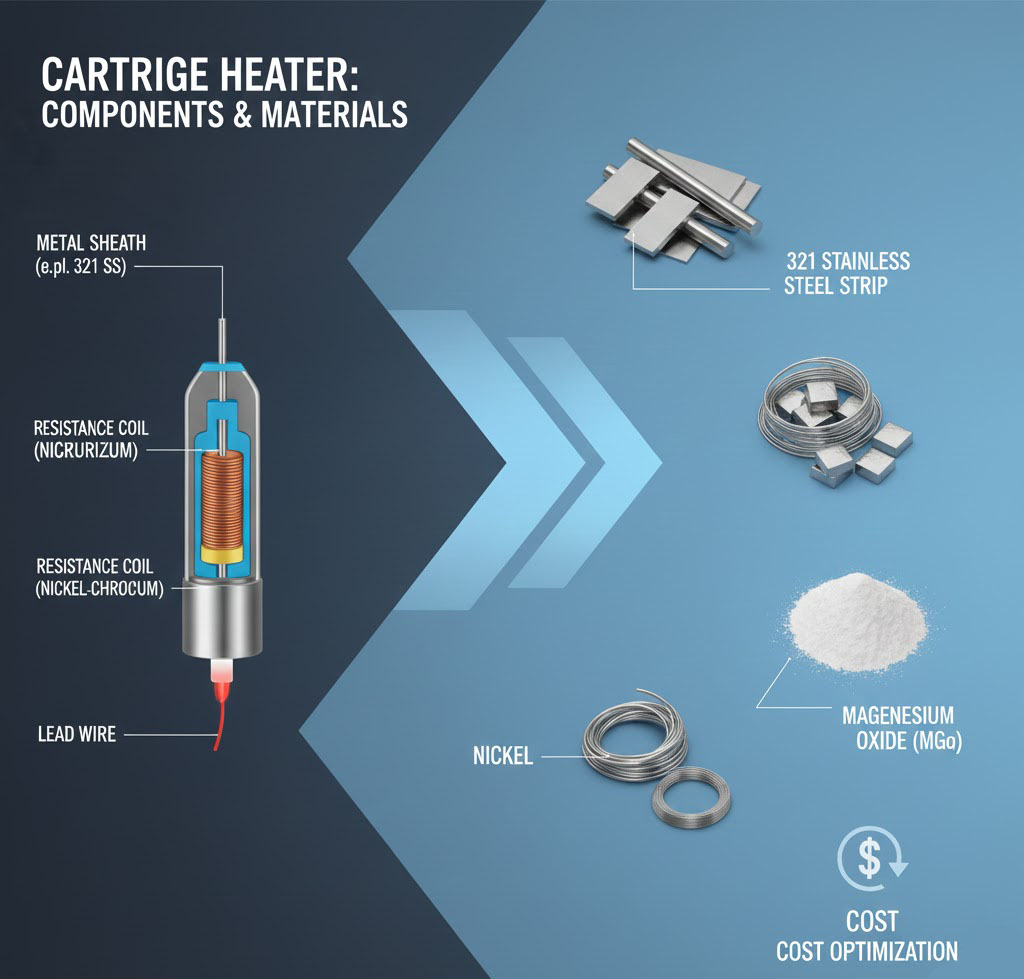

No, raw material costs are not expected to drive significant price increases for cartridge heaters. While nickel prices fluctuate, futures for 321 stainless steel strip show only a minor 2% increase by late 2025. Additionally, increased automation is further lowering per-unit labor costs, balancing any potential material rises.

From my perspective, understanding raw material costs is crucial for accurate forecasting. While many buyers worry about nickel prices, my analysis shows that they might not cause a major price hike for cartridge heaters. Nickel prices do fluctuate, I admit. However, the futures market for 321 stainless steel strip, a key component, indicates only a modest 2% increase by the fourth quarter of 2025. This small rise alone is not enough to drive a widespread price increase across the board.

Furthermore, I have observed a significant trend in manufacturing: increased automation. New production capacities, especially in Eastern China and Gujarat, India, are adopting automated coiling and filling equipment. This advanced technology directly reduces the manual labor required per unit. I have seen per-unit labor costs drop by $0.2–0.3. This efficiency gain helps offset any minor increases in raw material costs. It keeps the overall production cost stable. At ELEKHEAT, we leverage advanced equipment and technology. This allows us to maintain competitive pricing while ensuring the high quality and performance our clients expect. We are committed to optimizing our production processes.

Cost Influencers for Cartridge Heaters in 2026

| Cost Component | 2026 Outlook | Impact on Overall Price Trend |

|---|---|---|

| Nickel Prices | Volatile but not a dominant upward driver | Minor influence |

| 321 SS Strip | Futures show minimal (2%) increase by late 2025 | Insufficient for general price hike |

| Automation | New capacities lower labor costs ($0.2-0.3/unit) | Downward pressure on production costs |

| Energy Efficiency | Focus on optimization in manufacturing | Helps stabilize long-term costs |

I believe these factors will largely keep production costs in check, which is good news for buyers.

How Can I Optimize My Cartridge Heater Procurement?

Are you struggling to get the best deals for your cartridge heaters? Smart procurement strategies are key to cost savings. I will show you how to lock in favorable prices.

You can optimize procurement by locking in 6-month rolling contracts in early 2026, especially with a minimum order quantity of 2,000 units. My recommendation is to target FOB prices below $5 per unit for mid-range models. This strategy helps you secure stable costs and avoid potential risks related to nickel and shipping.

In my career, I have seen that timing is everything in procurement. For cartridge heaters, I firmly believe that the period from Q4 2025 to Q1 2026 presents the best window to secure favorable prices. First, nickel prices are currently at a low of around $18,000 per ton. This offers a good baseline. Second, new production capacities from India are expected to come online in Q2 2026, which will further intensify market competition. This means suppliers might be more open to negotiating beforehand.

Third, there's a unique overlap in February with China's Chinese New Year and India's Diwali. This creates a temporary capacity void. Placing orders early during this period can often lead to an additional 3–5% discount.

My strong recommendation for OEMs is to release 6-month rolling demand. Target a minimum order quantity (MOQ) of 2,000 units. For mid-range industrial-grade cartridge heaters, aim to lock in an FOB price of $4.6 per unit. This proactive approach can help control your 2026 average cost to below $4.9 per unit. This is significantly lower, about 50% less, than what you might pay through spot channels. It is also around $0.3 per unit lower than the 2025 average price.

While standard heaters remain stable, remember that high-end smart heaters with NiCr 800 sheaths and embedded thermocouples, driven by IoT and sensor premiums, may still see a 5% price increase, reaching $9–12 per unit. At ELEKHEAT, we understand these nuances. We are equipped to provide both cost-effective standard solutions and advanced customized heaters.

Strategic Procurement Actions for 2026

| Action | Benefit | Expected Outcome (Mid-Range) |

|---|---|---|

| Lock-in Period | Leverage low nickel prices and pre-competition | Best from Q4 2025 – Q1 2026 |

| Rolling Contracts | Ensures consistent supply and price stability | Avoids spot market volatility |

| MOQ 2,000 Units | Maximizes purchasing power, lowers unit cost | Target FOB $4.6/unit |

| Early Ordering (Feb) | Capitalize on holiday capacity gaps | Potential 3–5% additional discount |

| Consider High-End | Invest in smart features for future tech needs | Expect slight premium ($9–12/unit, +5%) |

I believe this strategy will help our clients achieve optimal cost efficiency for their heating element needs.

Conclusion

My analysis shows stable cartridge heater prices in 2026, with strategic procurement offering significant savings. Act early in Q1 2026 to optimize your costs and secure a competitive edge.